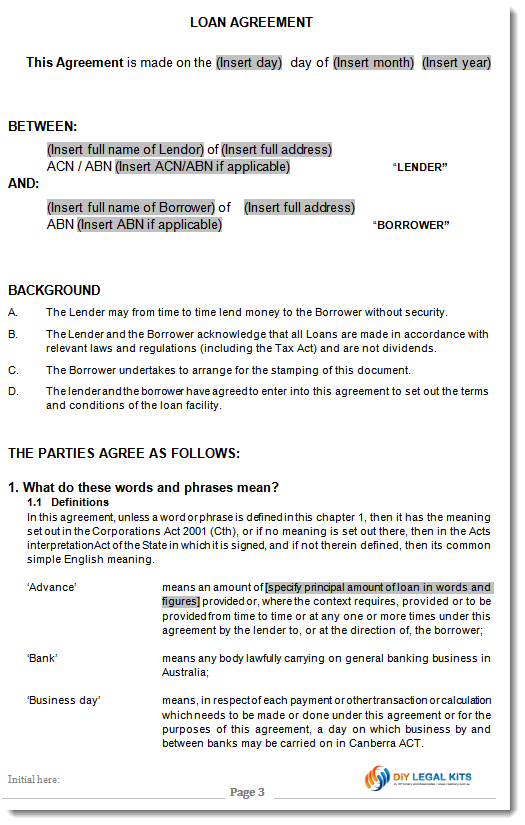

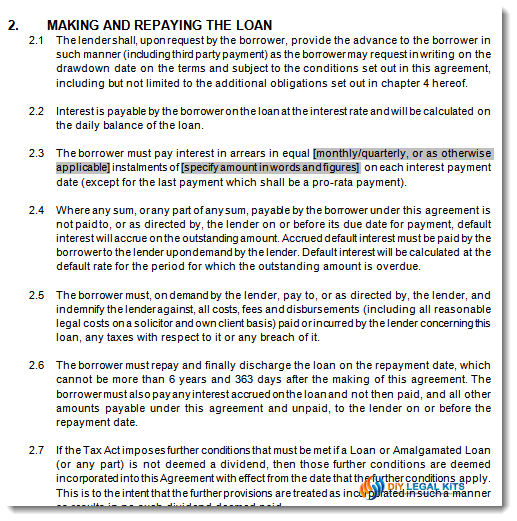

The Act makes it perfectly clear that such loans must be approved by the company and the borrower. Furthermore the agreement between the parties must be a qualifying written agreement that satisfies certain minimum interest rate and maximum term criteria.

Our Div 7A company loan agreement is a formal agreement prepared and signed by the company and the borrower. It ensures compliance under section 109N of the Act and protects your company from being deemed by the ATO to have given money to the borrower.

Your professionally drafted, easy to use Division 7A Company Loan Agreement is available for immediate download. The document comes to you as a Microsoft Word and PDF template that can be used as often as you like. Simply insert the correct information in the appropriate field and tab to the next. Now print your professional and legally binding contract!

The product was quick and service was good easily made some mods to the template, for the price and a legal saving of $900 well worth it.

Patrick M. Eagleby QLD

I phoned in twice got all the help required ,in a nice and helpful manner , plus in a nice and polite way , nothing was to much bother .Very many thanks.

Alan P. Nerang Qld

Choose from these three options